Bank Statement Loans for Self-Employed Borrowers

If you’re self-employed, your tax returns don’t always reflect your true income. Write-offs that lower your tax bill can also make qualifying for a traditional mortgage difficult.

If you’re self-employed, your tax returns don’t always reflect your true income. Write-offs that lower your tax bill can also make qualifying for a traditional mortgage difficult.

That’s where bank statement loans come in.

What Is a Bank Statement Loan?

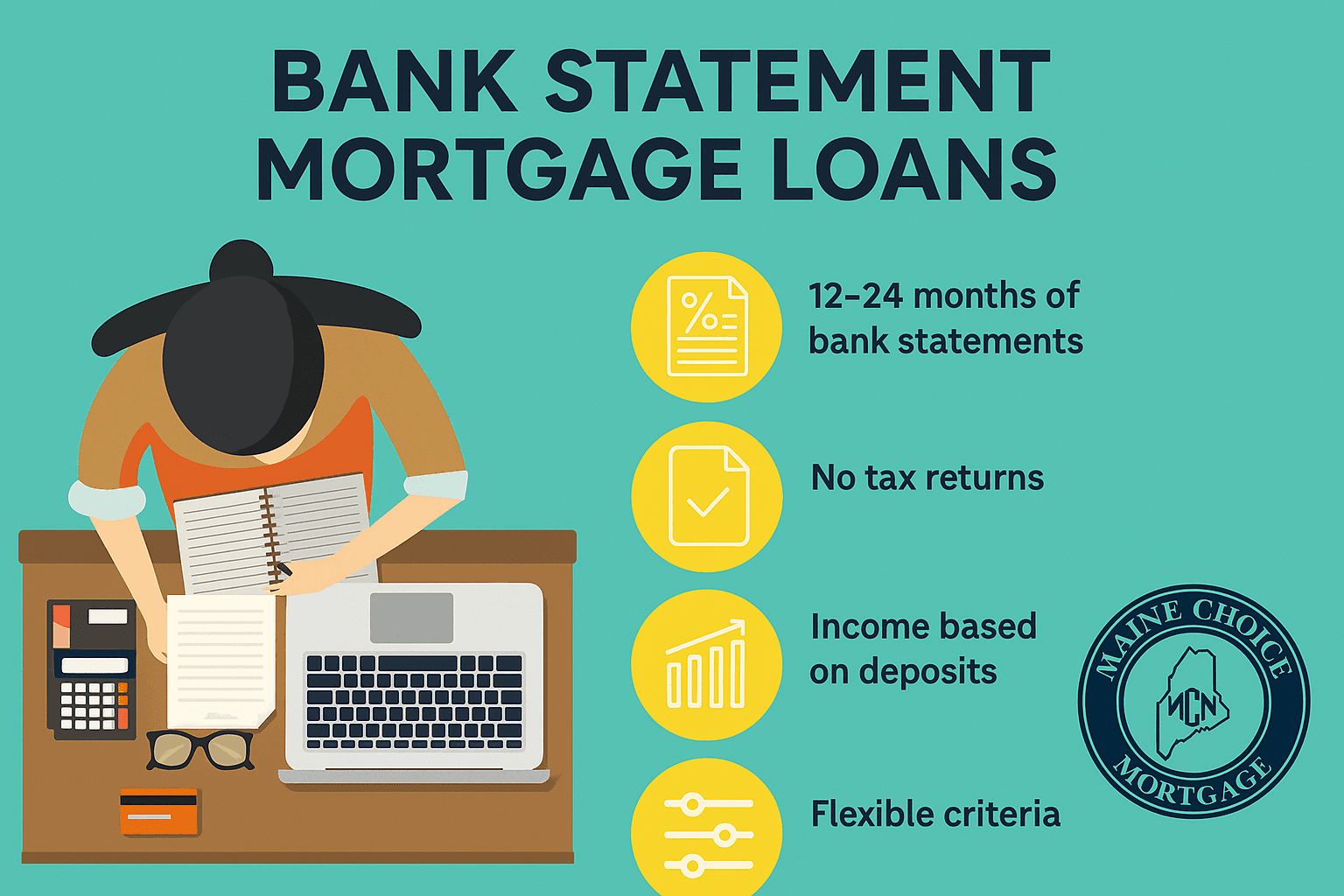

A bank statement loan allows self-employed borrowers to qualify using 12–24 months of personal or business bank statements instead of tax returns. Lenders review your deposits to calculate an average monthly income that better represents your real cash flow.

Who They’re Best For

Business owners and entrepreneurs

Freelancers and independent contractors

Commission-based professionals

Real estate investors

Key Requirements

Typically 660–700+ credit score

10–20% down payment

Proof of self-employment

Primary homes, second homes, and some investment properties allowed

If you’d like a quick review to see whether a bank statement loan makes sense for you, feel free to reach out.

Chuck Pine

Senior Mortgage Broker

Maine Choice Mortgage

📞 207-949-3770

📧 Contact Chuck Pine NOW!